19+ salary calculator nh

619 838 1056 1274 838 1056 1274 1492. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

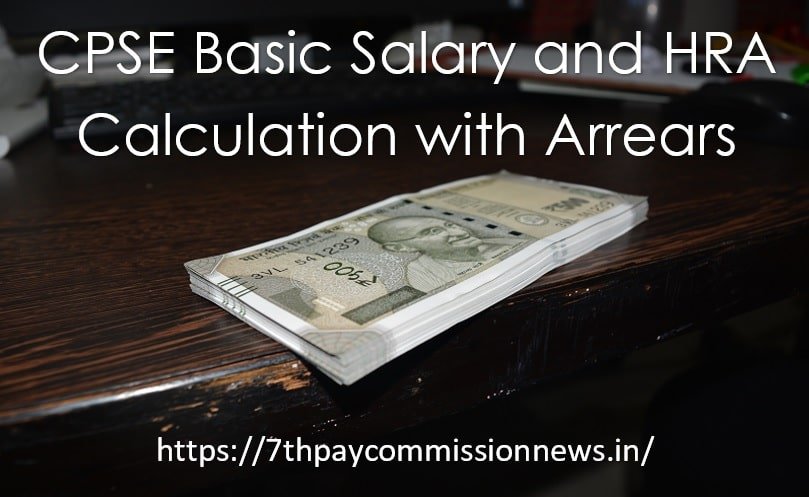

Gds Arrears Calculator With New Pay Revised New Calculator Po Tools

How much you pay in.

. Publish a Custom Salary Calculator. Welcome to the FederalPay GS Pay Calculator. Use ADPs New Hampshire Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. How to calculate annual income. New Hampshire offsets the no-tax situation with its property taxes which are some of the highest in the country.

The good news is the New Hampshire Salary Comparison Calculator is a diverse tool that supports all those salary comparison scenarios. Well do the math for youall you need to do is. Each salary calculation provides a full salary.

Enter the yearly salary which you will find listed on the job posting. The federal minimum wage is 725 per hour while New Hampshires state law sets the minimum wage rate at 725 per hour in 2022. For example if an employee earns 1500.

23 rows Living Wage Calculation for New Hampshire. Depending on your housing situation living in New. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New Hampshire.

Demands for a living wage that is fair to. How Your New Hampshire Paycheck Works. The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees.

Management 118492 Business Financial. So the tax year 2022 will start from July 01 2021 to June 30 2022. 19hour 760week 50 weeks 19hour 73077week 52 weeks Salary Chart.

Calculating your New Hampshire state income tax is similar to the steps we listed on our Federal paycheck. All other pay frequency inputs are assumed to. Calculate your New Hampshire net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New.

Switch to New Hampshire salary calculator. Just enter the wages tax. Regarding the pay rates this calculator produces for grades GS-1 through GS-4 for locations within the United States please be aware that beginning on the first.

New Hampshire paycheck calculator. Even in a state like New Hampshire that does not levy income tax on wages workers still have to pay federal income taxes. 19 an hour is how much a year.

Our 2022 GS Pay. To estimate your total compensation package when considering a full time position with the State of New Hampshire. Add Rate Remove Rate.

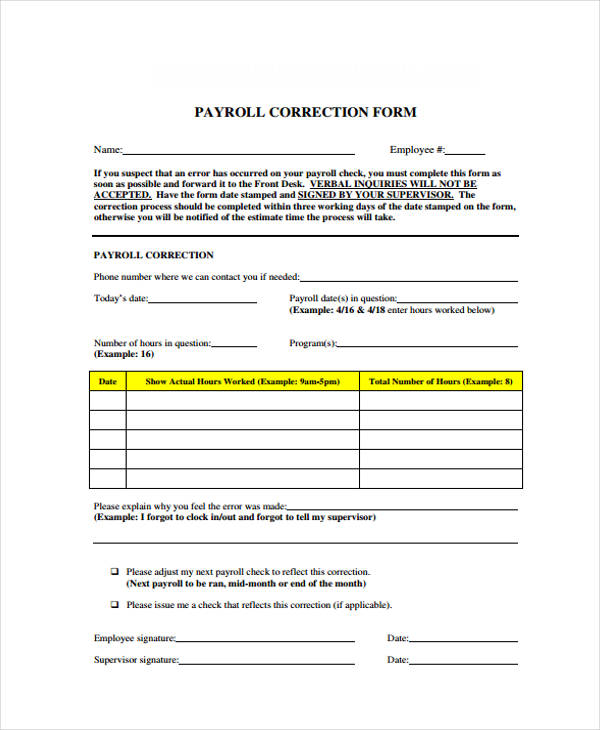

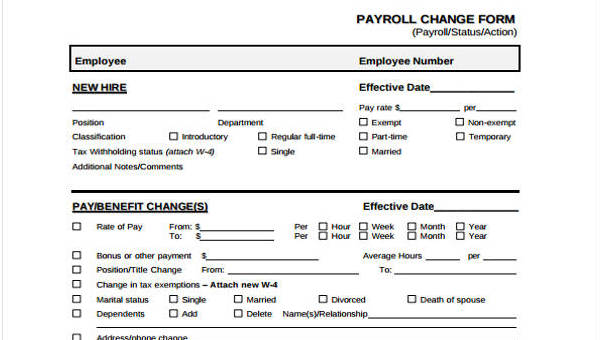

Free 42 Sample Payroll Forms In Pdf Excel Ms Word

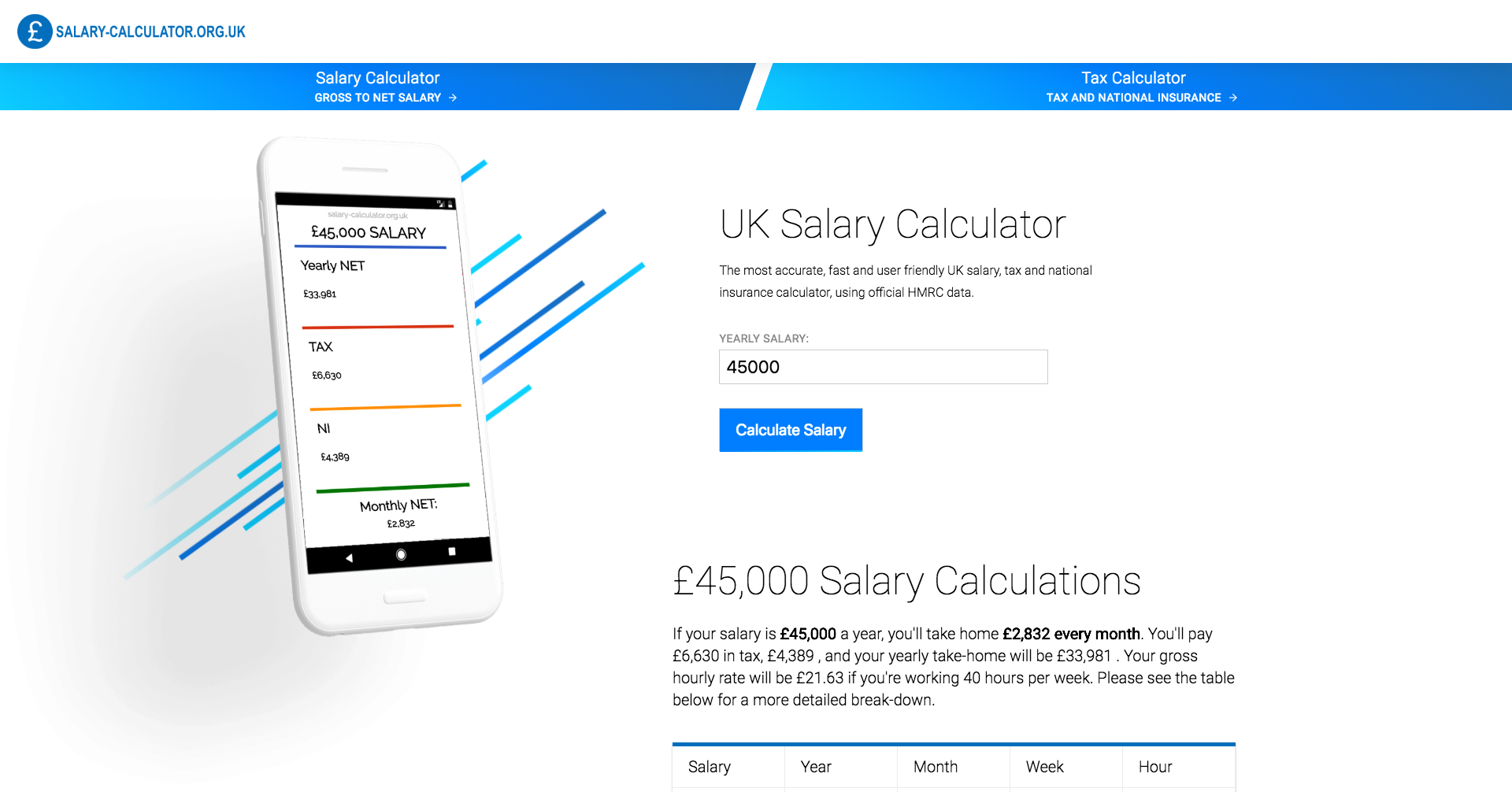

25 000 After Tax Salary Calculator Uk

3 Bhk Flats In Kochi 703 Apartments Flats For Sale In Kochi

186 Barnett Hill Road Walpole Nh 03608 Mls 4910577 Zillow

Avusturya Izin Yolu Gurbetciler

Tl June29 0 By Mid America Publishing Corporation Issuu

Psu Pay Scale Calculator Cda Pay Scale Calculator Central Government Employees Latest News

Other Student Types Georgia State Admissions

Hanyu Jiaocheng 2 1 Eng Pdf Pdf

Coronavirus Stimulus Checks And Other Relief Payments October 2022 Compacom Compare Companies Online

Jora Credit Personal Installment Loans Reviews October 2022 Compacom Compare Companies Online

Basic Salary Increment Break Up Calculator Ctc To In Hand Salary Calculator 2022 Central Government Employees Latest News

268 Governor Wentworth Highway Wolfeboro Nh 03894 Mls 4931830 Zillow

Free 42 Sample Payroll Forms In Pdf Excel Ms Word

Reliable Reports Inc Reviews What Is It Like To Work At Reliable Reports Inc Glassdoor

Real Estate Agents In Putha Village Meerut Property Dealers Brokers

University Heights Apartments 15 Princeton Drive Hooksett Nh Rentcafe